Technical analysis for GBPUSD:

Market Context

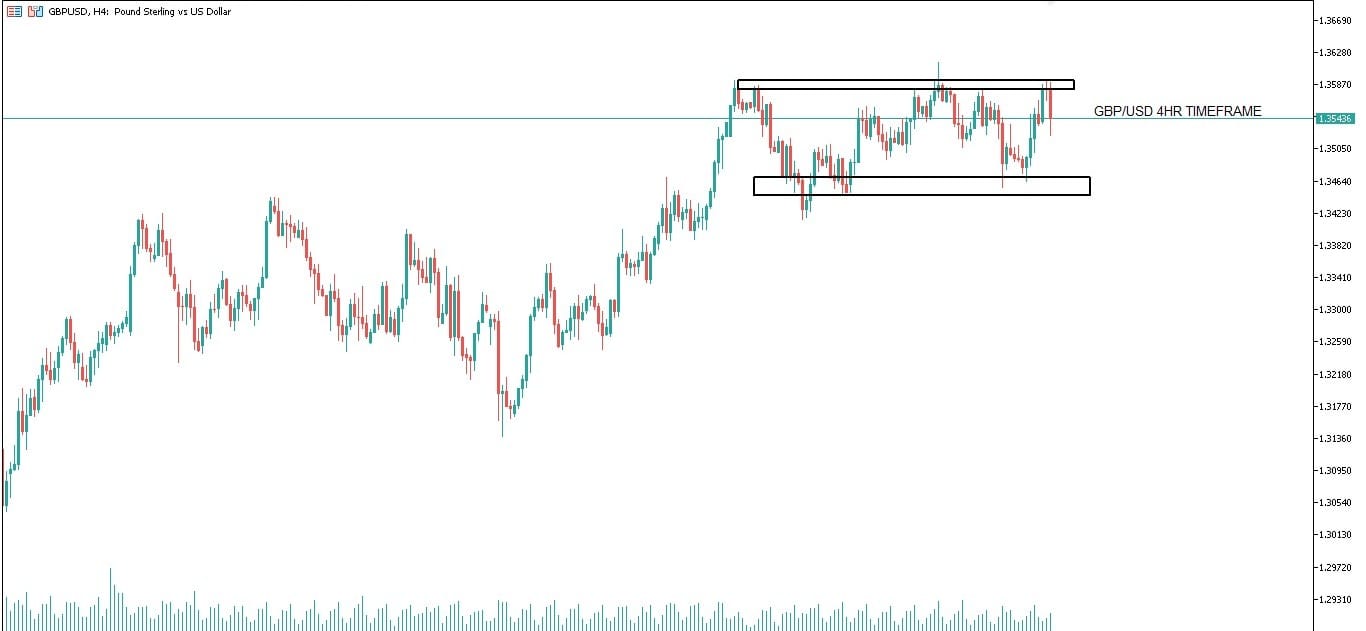

Support at 1.34988: This is a key horizontal level that previously acted as a buy zone.

Resistance at 1.35846: A supply zone or prior swing high where sellers stepped in before.

Technical Structure

Element Description

Trend Neutral to bullish short-term, depending on price behavior above support.

Support 1.34988 — Watch for potential bullish price action (e.g., bullish engulfing, hammer).

Resistance 1.35846 — May trigger selling pressure if tested without momentum.

Scenarios

Bullish Case (Reversal or Continuation)

Price holds above 1.34988 with bullish candlestick confirmation.

Targets:

1.35846 (short-term)

Breakout above 1.35846 → potential continuation toward 1.36400 or higher.

Volume/RSI/MACD should support upward momentum for breakout.

Bearish Case (Breakdown)

Break and close below 1.34988 confirms bearish sentiment.

Retest and failure at 1.34988 = short setup.

Next possible target: 1.34400 or 1.33800 (lower support zones).

Indicators for Confluence

Indicator Signal to Watch

RSI Overbought near resistance or oversold near support.

MACD Bullish crossover near 1.34988 = buy signal.

Volume Spike near breakout levels = likely continuation.

Leave A Comment