📈 XAG/USD (Silver vs USD) – H4 Timeframe Analysis

🗓️ Updated as of 2nd June 2025

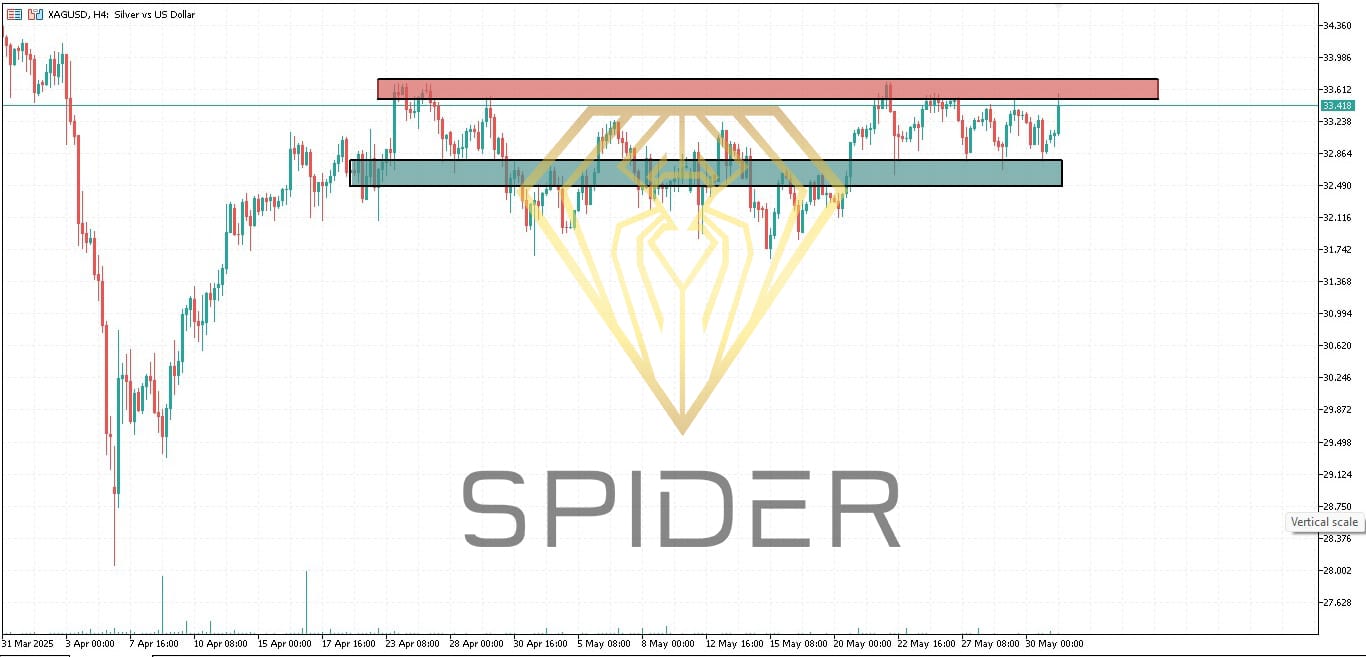

🔍 Current Market Structure

Silver has entered a clear consolidation phase on the H4 timeframe.

- 📌 Range Bound Zone:

- Resistance Zone: $33.60 – $33.80 🔴

- Support Zone: $32.60 – $32.85 🟩

- Price is currently hovering near $33.41, testing the upper resistance.

📊 Technical Outlook

🔸 Bullish Momentum Still Active

- The overall trend remains bullish since the March–April breakout.

- Price has been making higher lows, indicating buyer strength, despite consolidation.

🔸 Current Pattern: Sideways Accumulation (Box Range)

- Price is stuck in a rectangular range, typically a prelude to a breakout.

- If price breaks above $33.80 with volume, expect continuation toward $34.30 → $34.80.

🎯 Trade Scenarios

✅ Bullish Breakout Strategy

- Entry: Break and close above $33.80

- Targets: $34.30 → $34.80

- Stop Loss: Below $33.20

🔄 Range Trading Strategy (until breakout occurs)

- Buy Near Support: $32.60 – $32.85

- Sell Near Resistance: $33.60 – $33.80

- Stop Loss: Tight SL of 30–40 cents outside the zones.

🚨 Bearish Breakdown Scenario

- Entry: Close below $32.60

- Targets: $32.10 → $31.60 (old demand zone)

- SL: Above $32.90

⚠️ Risk Events to Watch

- 🏦 U.S. Non-Farm Payrolls (NFP) – Expected Friday

- 💹 USD Index volatility – Inverse relation with Silver

- 🏭 Global PMI data – Impacts industrial metal demand

📌 Conclusion

Silver is ranging within a strong accumulation zone. A breakout above $33.80 can ignite the next bullish rally. Until then, it’s a smart range-trading setup for both short-term bulls and bears. Stay alert for high-volume breakouts.

Leave A Comment