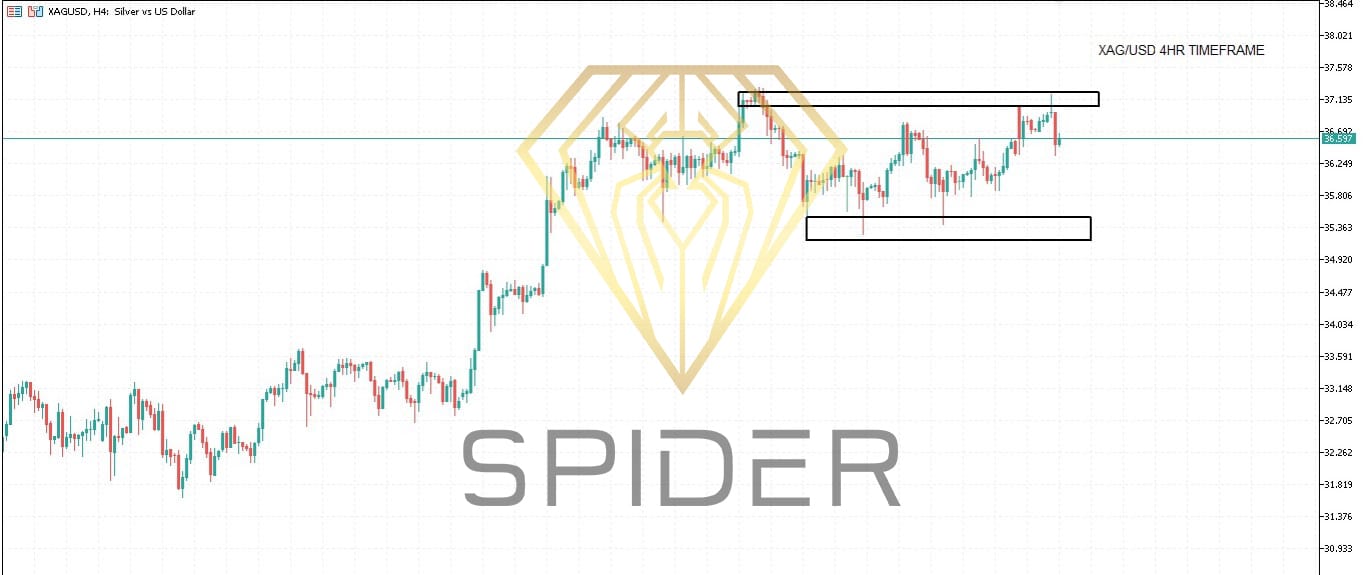

XAG/USD (Silver) Technical Analysis — 4H Timeframe

Current Price: Not provided (based on structure)

Resistance Level: 37.15510

Support Level: 35.49214

Market Structure Overview:

• Silver (XAG/USD) is currently trading within a defined range between the strong support zone at 35.49214 and the resistance zone at 37.15510.

- The overall price action shows consolidation, with several price reactions confirming both levels as significant.

- Price has recently approached or is approaching the resistance zone, making this area critical for the next directional move. Bullish Scenario:

A confirmed breakout and sustained move above 37.15510 would indicate bullish continuation.

Buyers may target the next levels at:

37.50000 (psychological round number)

38.20000 (previous swing high zone)

Bullish Entry: After confirmed breakout and retest of 37.15510, look for bullish candlestick patterns like bullish engulfing or pin bars

Stop Loss: Below 36.90000

First Target: 37.50

Second Target: 38.20

Bearish Scenario:

If price fails to break above 37.15510 and shows rejection signals (e.g., bearish pin bars, shooting star candles), expect a potential pullback toward support.

Breakdown below 35.49214 would signal bearish continuation toward:

35.00000

34.50000

Bearish Entry: On bearish rejection near 37.15510, or breakdown below 35.49214.

Stop Loss: Above 37.30000

First Target: 35.49214

Second Target (if breakdown): 35.00000

Additional Considerations:

Silver often reacts to USD strength, inflation news, and risk sentiment. Watch for global macroeconomic updates.

Increased volatility may occur around key U.S. economic releases or Federal Reserve announcements.

Leave A Comment