EUR/USD Analysis – June 2025

Key Technical Levels

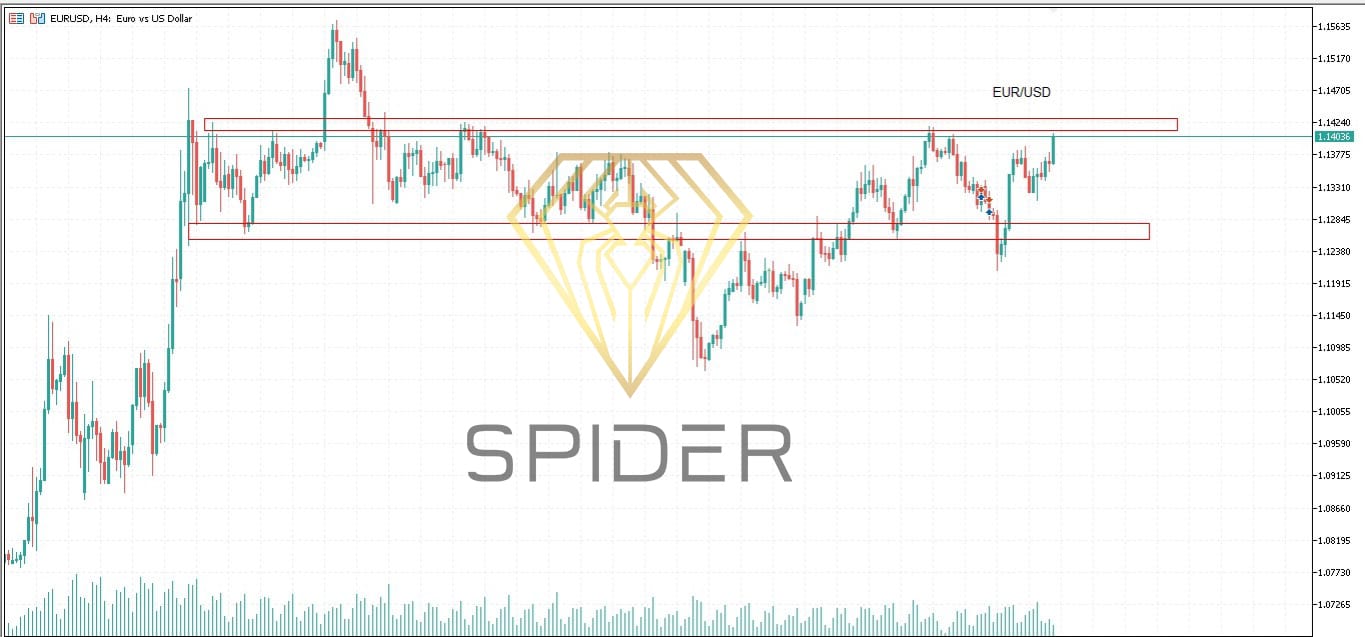

Support: 1.12715

→ This is a medium-term demand zone tested in late May; bulls often defend this level.

Resistance: 1.14107

→ This level has capped gains repeatedly since Q1; a bullish breakout zone.

Technical Analysis

Support – 1.12715

Structure: This is a strong horizontal support with confluence from March lows.

Buyers typically step in here, making it a key pivot area.

If it breaks, next support lies at 1.1210 and 1.1145.

Resistance – 1.14107

Structure: A historical supply zone tested in April and again last week.

Breakout scenario: If EUR/USD closes above 1.1410 with volume, the next leg up could target 1.1485 and 1.1550.

Range Status:

Current momentum shows mild bullish pressure with higher lows forming, hinting at a potential breakout.

RSI: Hovering near 60, suggesting positive momentum without being overbought.

MACD: Bullish crossover forming on the daily chart.

Fundamental Factors Affecting EUR/USD

Eurozone Outlook

ECB is slowly shifting toward a dovish stance but still more stable than the Fed.

German GDP is recovering; industrial output has improved.

Eurozone inflation is declining toward target, which gives the ECB room to ease later in the year.

US Outlook

Fed is likely to cut rates in Q3 as inflation cools and job growth slows.

USD under pressure from:

Potential Trump-era tariffs

Lower bond yields

Weak ISM services and manufacturing data

Trading Strategy

Bullish Breakout (Above 1.14107)

Entry: 1.1420

Target: 1.1485 → 1.1550

Stop: 1.1375

Confirmation: Daily close above resistance with increased volume

Bearish Rejection (From 1.14107)

Entry: 1.1395

Target: 1.1310 → 1.1271

Stop: 1.1435

Trigger: Hawkish Fed comments or risk-off sentiment

If Breaks Below 1.12715

Watch for fast move toward 1.1210 as stop orders may trigger.

Conclusion

EUR/USD is approaching a breakout point.

As long as 1.12715 holds, bullish bias remains.

A breakout above 1.1410 can lead to an extended rally.

Leave A Comment