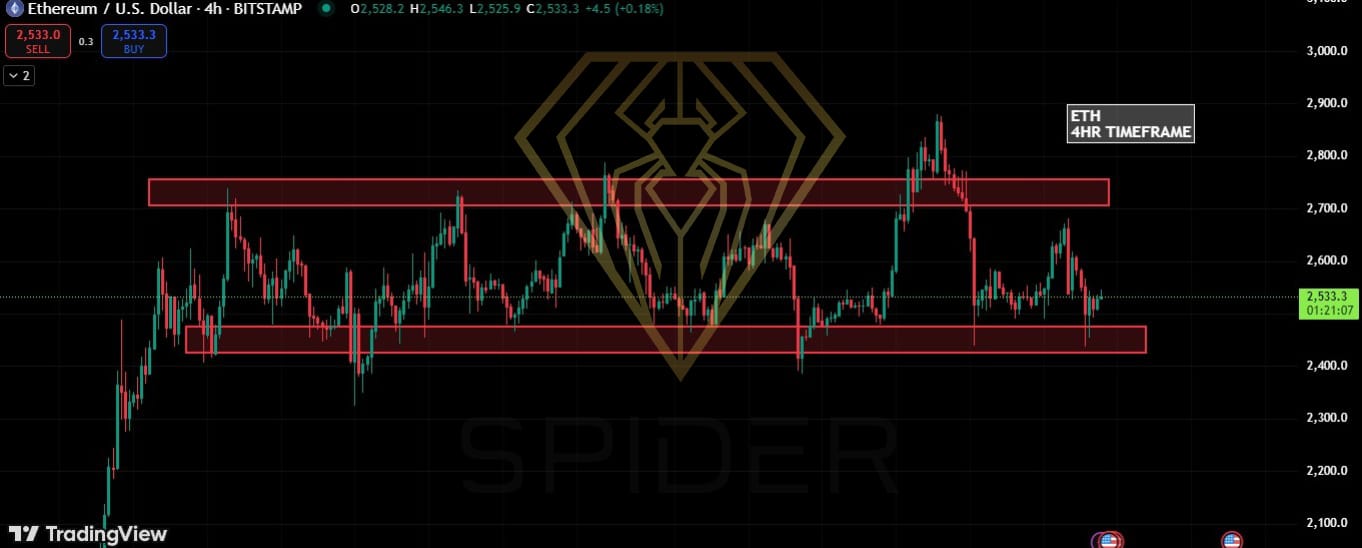

Technical Breakdown For ETH

Resistance at 2733.7

Observation: ETH faced repeated rejection at 2733.7, confirming it as a strong resistance zone.

Implication: Sellers are active at this level, and failure to sustain above it often leads to pullbacks.

⚠️Fake Breakout Above 2787.6

Event: ETH broke above 2787.6, but quickly fell back below.

Interpretation:

This is a bull trap — price attracted breakout traders but lacked volume or momentum to sustain.

It indicates weak bullish conviction and potential for downside pressure.

Market Psychology: Traders who bought the breakout are now trapped and may contribute to selling pressure.

Support at 2429.8

Importance: This is a crucial support level and possible demand zone.

Implication:

If ETH falls further, 2429.8 is the next major level to watch for a bounce.

A breakdown below 2429.8 could trigger deeper losses.

Market Structure Outlook

Bullish Scenario

Condition: ETH must reclaim 2733.7 with strong momentum and retest 2787.6 with confirmation.

Confirmation Signals: High volume breakout, higher low formation, bullish candlestick structure.

Targets: 2850–2900 (next resistance zone).

Bearish Scenario

Condition: Sustained rejection below 2733.7 + confirmation of the fake breakout.

Likely Path: Continued selloff toward 2520, and potentially support at 2429.8.

Break Below 2429.8: Signals deeper correction — could target 2300 or lower.

📉Summary

ETH is currently bearish-to-neutral after a fake breakout above 2787.6.

2733.7 remains a solid resistance.

2429.8 is the critical support that must hold to prevent further downside.

Trade with caution near these key zones, and wait for confirmation before positioning.

Leave A Comment