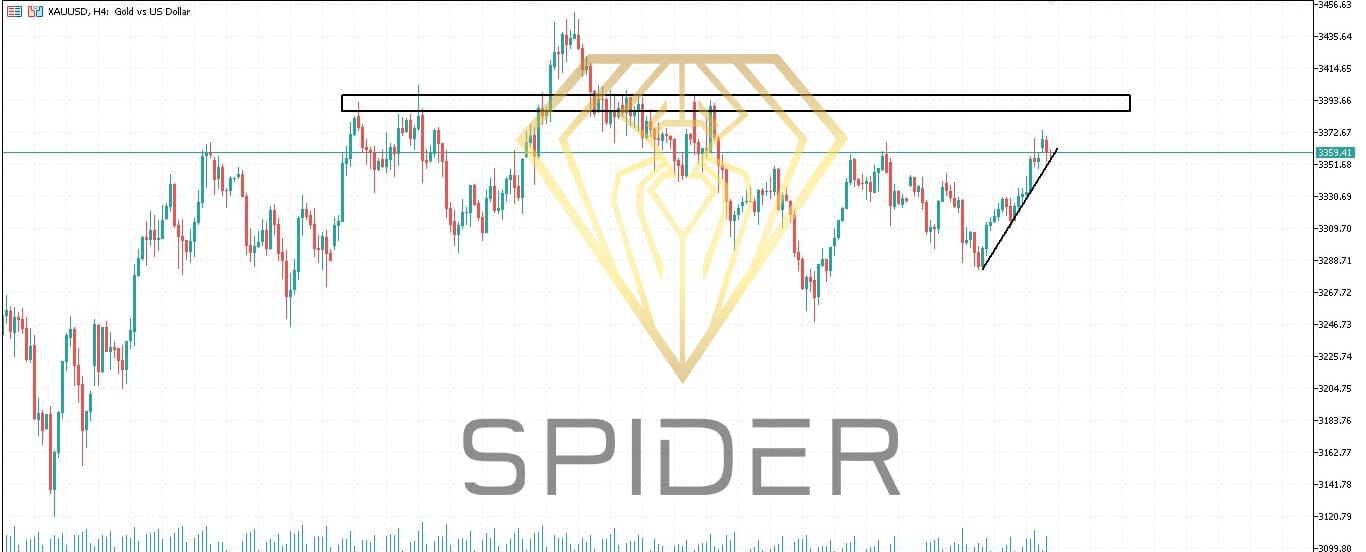

XAU/USD (Gold) 4H Chart Analysis

Key Technical Elements

Resistance Zone

Located around 3393.00 – 3415.00

• This area has acted as a major supply zone, where price was previously rejected multiple times in early June and mid-June.

- Price is currently testing the lower boundary of this resistance. Bullish Trendline Support

- The rising black trendline shows higher lows, suggesting strong buyer interest.

- Price has respected this trendline since around July 5, forming a short-term ascending triangle pattern. Market Structure:

Current price: 3359.41

Price is approaching a confluence point: where the ascending trendline meets horizontal resistance.

This tight structure typically leads to either:

A bullish breakout above the resistance zone

Or a rejection and breakdown below the trendline Bullish Breakout Scenario:

If price breaks and closes above 3415, especially with strong volume:

Expect potential targets: 3445, 3480, and even 3510

Retest of the 3393–3415 zone as support can offer confirmation

Supported by global risk sentiment or weaker USD fundamentals Bearish Rejection Scenario:

A clear rejection near 3393–3410 combined with a break below the rising trendline can trigger a move lower.

First downside targets: 3320, 3280, and the support zone near 3250

RSI or volume divergence would support this view Signal Watch:

Aggressive trade: Short near resistance with SL above 3415

Conservative trade: Buy breakout with confirmation above 3415 and retest

Leave A Comment