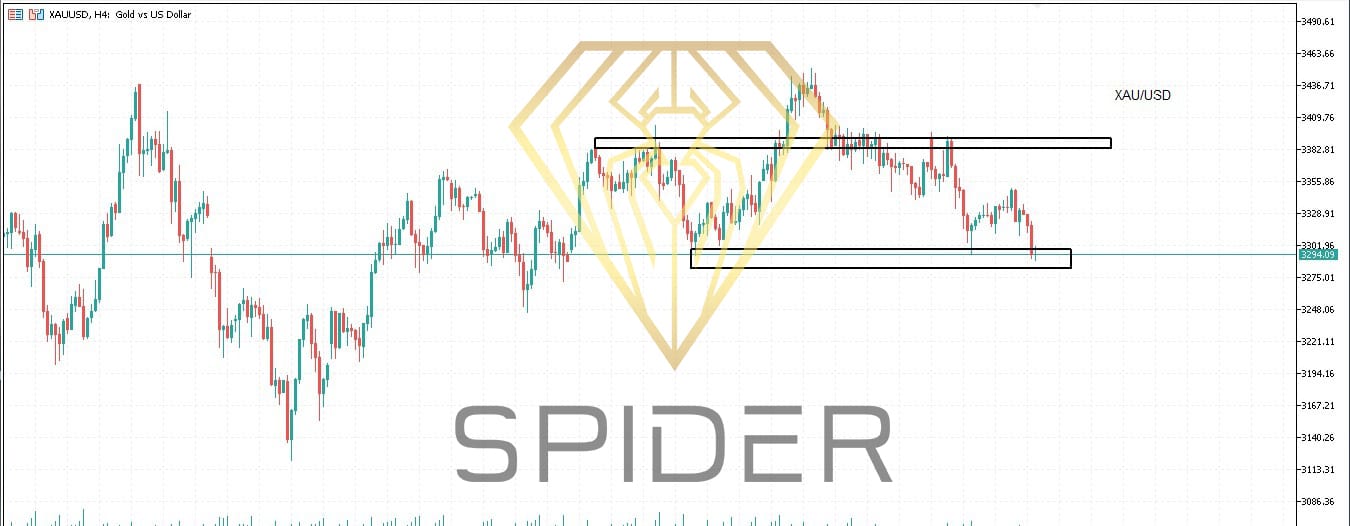

Technical Analysis for XAU/USD (Gold) — 4H/1D Outlook

Support Level: 3292.68 USD

Resistance Level: 3388.67 USD

Current Market Outlook:

Support Zone 3292.68:

Price recently respected this support, showing significant buyer interest around this area. It’s a strong psychological and technical demand zone.

Resistance Zone 3388.67:

Price action faces clear resistance near 3388.67, which aligns with previous rejection zones. Bulls need a confirmed breakout above this level for continuation.

Scenarios to Watch:

Bullish Bias (If Breakout Occurs):

Break and sustained close above 3388.67

Next upside targets:

→ 3420.00 (minor psychological level)

→ 3460.00 (next technical resistance)

Potential Buy Signal:

Look for bullish candles (engulfing, pin bars) above 3388.67

Confirmation via volume spike or RSI > 60

Bearish Bias (If Rejection Happens):

Price rejects 3388.67 and forms bearish patterns

Potential pullback toward 3292.68 support

If 3292.68 breaks, next downside target:

→ 3250.00

→ 3200.00

Sell Signals:

Bearish engulfing or shooting star at resistance

RSI divergence with price near 3388.67

Momentum Indicators:

RSI: Monitor for overbought signs above 70 or bullish divergence near support

Volume: Increasing volume near breakout confirms strength

MACD: Bullish crossover indicates potential upside continuation

Trade Setup Suggestion:

Scenario Entry Stop Loss Target 1 Target 2

Bullish Break Above 3390 3365 3420 3460

Bearish Rejection Near 3385 3405 3325 3295

Note:

Watch for upcoming U.S. economic news (PCE data, Fed speakers) as they heavily impact XAU/USD volatility.

Geopolitical tensions (e.g., Iran-Israel developments) can also spike safe-haven demand for Gold.

Leave A Comment