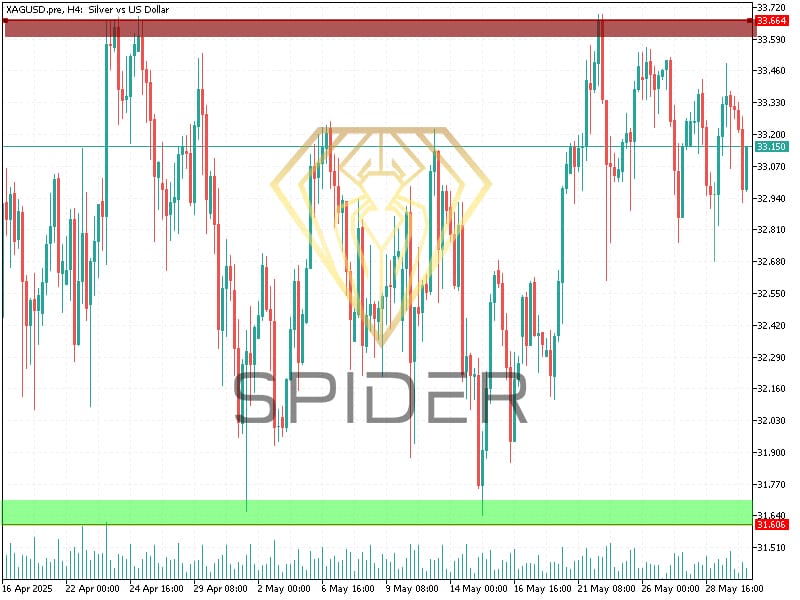

📈 Technical Analysis: XAG/USD (Silver vs. US Dollar) – H4 Timeframe

🔍 Current Price Action & Trend

- Latest Price: $31.51 (as per last data point)

- Dominant Trend: Bullish (Higher highs & higher lows from $31.64 → $31.00 → $31.51).

- Key Pattern: Pullback after breakout (Retesting support after spike to $31.00).

📊 Critical Levels

| Type | Level | Significance |

|---|---|---|

| Resistance | $32.03 | Previous swing high (16 May) |

| $31.90 | Recent consolidation zone | |

| Support | $31.51 | Current price – Immediate defense line |

| $31.00 | Major psychological & breakout level (21 May) | |

| $31.64 | Strong historical support (16 May) |

📉 Technical Indicators

- Price Structure:

- Bullish Breakout: Surge to $31.00 (21 May) broke $31.64 resistance.

- Retest in Progress: Current pullback to $31.51 testing breakout validity.

- Volatility Insight:

- Sharp drop from $31.00 → $31.51 suggests profit-taking.

- Holding above $31.00 keeps bulls in control.

🎯 Trade Strategy

Scenario 1: Bullish Continuation

- Trigger: Bounce from $31.51 or $31.00 support.

- Entry: $31.30 – $31.50

- Targets: $31.90 → $32.03 → $32.30

- Stop Loss: Below $31.00 (breakout invalidation).

Scenario 2: Bearish Reversal

- Trigger: Close below $31.00 with momentum.

- Entry: $30.95

- Targets: $31.64 → $31.90 (role reversal to resistance)

- Stop Loss: Above $31.20.

⚠️ Key Risk Events

- US Inflation Data: Impacts USD strength → Silver volatility.

- Industrial Demand Signals: Watch for PMI data from US/China.

📌 Tactical Insight

“Buy the dip near $31.00 if USD weakens. A hold above $31.00 opens path to $32.30.

Failure below $31.00 signals bull trap → target $31.64.”

Leave A Comment